Introduction To BAE Share Price

When investing in the defense industry, BAE Systems is a significant player.

As one of the world’s leading defense contractors, BAE Systems’ share price attracts substantial attention from investors.

But what drives the share price of this industry giant, and how can investors make informed decisions?

Let’s delve into the details and uncover the intricacies of BAE’s share price.

Historical Performance

The historical performance of BAE Systems’ shares provides valuable insights into its long-term stability and growth. Over the past decade, BAE has experienced several milestones that have significantly impacted its share price. These events have shaped the company’s market trajectory from major defense contracts to strategic acquisitions.

Current Market Position

BAE Systems’ recent performance showcases its resilience and adaptability in a competitive market. We can gauge BAE’s standing in the industry by comparing its performance with key competitors. The company’s ability to secure lucrative contracts and maintain a robust pipeline of projects speaks volumes about its market position.

Factors Influencing Share Price

Understanding the factors influencing BAE Systems’ share price is crucial for investors. These factors can be broadly categorized into economic, industry-specific, and company-specific factors. Each category plays a unique role in shaping the market perception and valuation of BAE’s shares.

Economic Factors

Global economic conditions are a significant determinant of BAE’s share price. Fluctuations in interest rates, inflation, and overall economic stability can have ripple effects on the defense industry. Investors must monitor these macroeconomic indicators to predict potential impacts on BAE’s market performance.

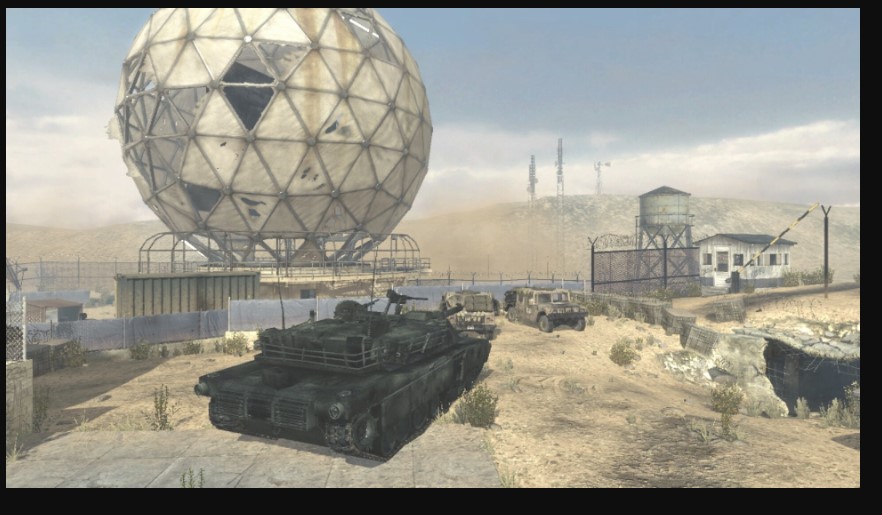

Industry-Specific Factors

Government policies and spending heavily influence the defense industry. Trends in defense budgets, military modernization programs, and geopolitical tensions can all drive demand for defense contractors like BAE Systems. Staying informed about industry trends is essential for anticipating market movements.

Company-Specific Factors

BAE Systems’ financial health and operational efficiency are pivotal in determining its share price. Recent earnings reports, major contracts, and ongoing projects show the company’s performance. Investors should closely analyze these factors to assess BAE’s growth potential.

Investment Strategies

Different investment strategies can be employed based on an investor’s goals and risk tolerance. Short-term trading strategies focus on capitalizing on market volatility, while long-term investment strategies emphasize sustained growth and dividend yields. Understanding these strategies can help investors optimize their returns.

Technical Analysis

Technical analysis involves studying price movements and trading volumes to predict future trends. Key technical indicators such as moving averages, RSI, and MACD can provide insights into potential buy or sell signals. Additionally, identifying chart patterns can help investors make informed decisions.

Fundamental Analysis

Fundamental analysis evaluates a company’s intrinsic value by examining financial metrics. For BAE Systems, important metrics include the P/E ratio, dividend yield, and earnings per share (EPS). These metrics offer a deeper understanding of the company’s valuation and profitability.

Risk Factors

Investing in BAE Systems, like any investment, involves risks. Market volatility, political and regulatory risks, and geopolitical tensions can all impact the company’s share price. Being aware of these risk factors is crucial for making informed investment decisions.

Expert Opinions

Financial analysts and industry experts provide valuable insights into BAE Systems’ market performance. Their recommendations and analyses can guide investors on whether to buy, hold, or sell BAE shares. Tracking expert opinions can help investors stay updated with market trends.

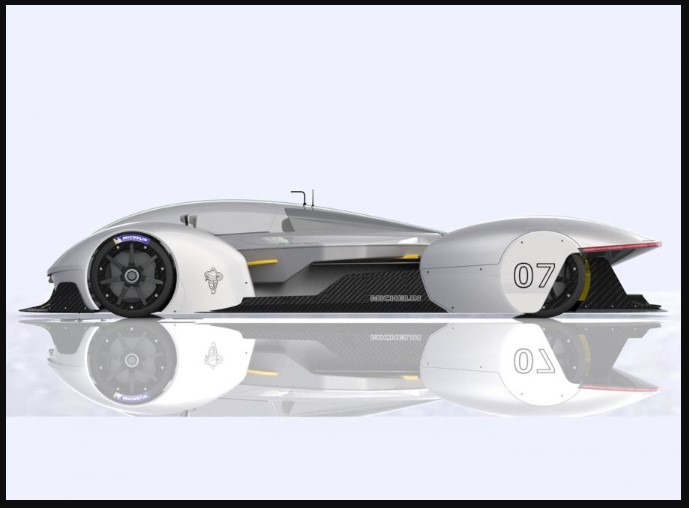

Future Outlook

BAE Systems’ future outlook is promising, with several upcoming projects and innovations on the horizon. Predictions for future performance can help investors gauge the company’s growth potential. Staying informed about future developments is key to making strategic investment decisions.

Conclusion

In conclusion, BAE Systems is a formidable player in the defense industry, with a robust historical performance and promising future outlook. Understanding the factors influencing its share price, combined with strategic analysis and expert insights, can empower investors to make well-informed decisions. Whether you’re considering short-term trading or long-term investment, BAE Systems offers many opportunities.

FAQs

What is the current share price of BAE Systems?

The current share price of BAE Systems can be found on major financial news websites or stock market platforms. It’s important to check for real-time updates to get the most accurate information.

How can I buy BAE shares?

You can buy BAE shares through a brokerage account. Search for BAE Systems using its ticker symbol and place an order through your broker’s trading platform.

What factors should I consider before investing in BAE?

Before investing in BAE, consider the company’s financial health, industry trends, economic conditions, and potential risks. Technical and fundamental analysis can provide a comprehensive view of the investment.

How does BAE compare to other defense companies?

BAE Systems is one of the largest defense contractors globally. Comparing its financial performance, market position, and project pipeline with other defense companies can provide insights into its competitive standing.

What is the future outlook for BAE Systems?

BAE Systems’ future outlook is positive, with several upcoming projects and innovations expected to drive growth. Staying updated on industry trends and company announcements can help gauge future performance.